The profit margin of steel enterprises in the fourth quarter may decrease due to high input costs

BSC forecasts that gross profit margins of steel enterprises in the fourth quarter may decrease due to high input costs, while domestic consumption has not improved.

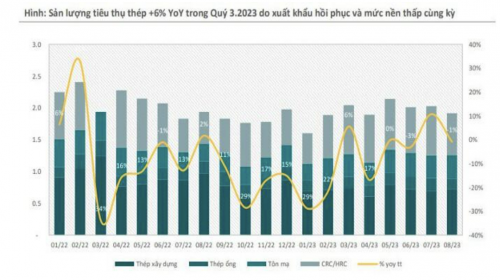

In the fourth quarter commodity outlook report, BIDV Securities Joint Stock Company (BSC) said that in the third quarter, steel consumption reached 6 million tons, flat compared to the second quarter and up 6% over the same period in 2022.

.png)

(Source: BSC)

BSC believes that steel consumption in the fourth quarter may be less positive. According to the analysis department, export output peaked in July and August and may gradually decrease in the fourth quarter because consumption demand is still weak, and the import trend of the EU and US will go down towards the end of the year.

Similarly, domestic steel consumption is also forecast to not improve. In September, factories still had to push steel export channels to compensate for domestic demand.

Steel businesses have little chance of increasing steel prices even though production costs have increased. The price of this item has remained in a downward trend since April until now.

BSC forecasts that world steel prices in the fourth quarter may move sideways because supply and demand have been balanced. Meanwhile, domestic steel prices will still be under slight downward pressure, mainly due to weak domestic purchasing power and Vietnamese steel facing competition from Chinese goods.

The analysis department said that the gross profit margins of steel enterprises were differentiated in the third quarter.

The gross profit margin of Hoa Sen and Hoa Phat increased by 2.3-2.5 percentage points compared to the previous quarter because the price of input materials decreased sharply at the end of the second quarter. This is the basis for businesses to have better capital prices, while export output remains high.

On the contrary, Nam Kim's gross profit margin decreased by 5 percentage points mainly due to reduced export prices.

"The gross profit margin of steel enterprises in the fourth quarter may decrease due to high input costs, while domestic consumption has not improved," BSC forecasts.

The analysis department said that in the fourth quarter, the steel industry may continue to compete with Chinese goods, when the amount of imports from the country of 1.4 billion people in the third quarter increased by 52% over the same period.

In case the Chinese economy recovers slowly, steel mills will tend to boost steel exports to neighboring markets, including Vietnam.

In addition, the steel industry also faces the risk of anti-dumping taxes being imposed because in the first 8 months of 2023, China and Vietnam are among the largest steel exporting countries in the world.

Source: vietnambiz.vn

.png)

Write a comment