A Chinese product is continuously landing in Vietnam at record low prices: 0% import tax, Vietnam spent more than 5 billion USD purchasing it last year.

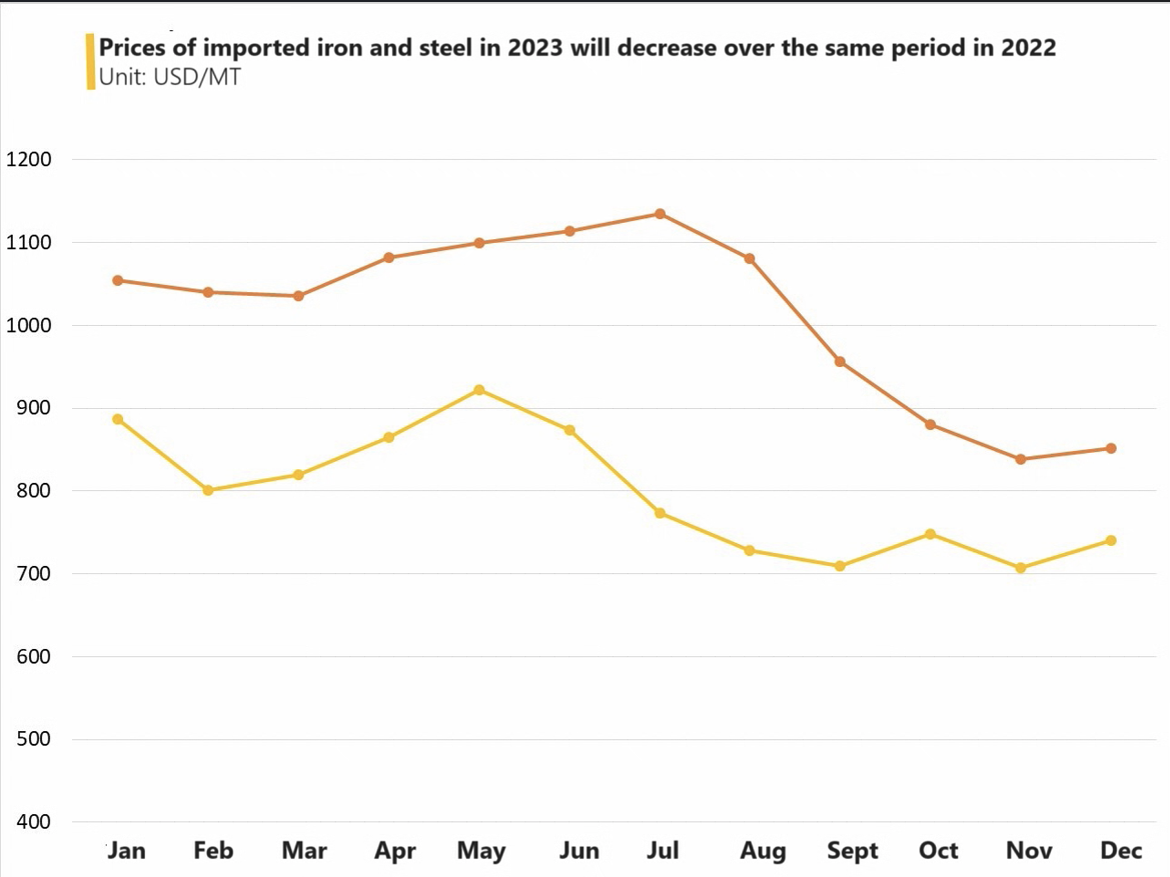

The import price of this item from China has decreased by more than 30% over the same period.

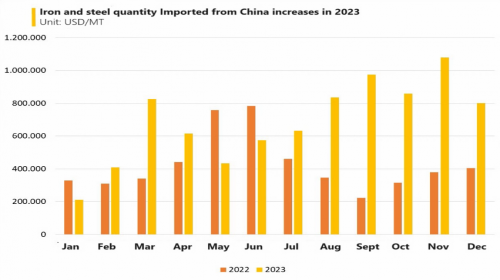

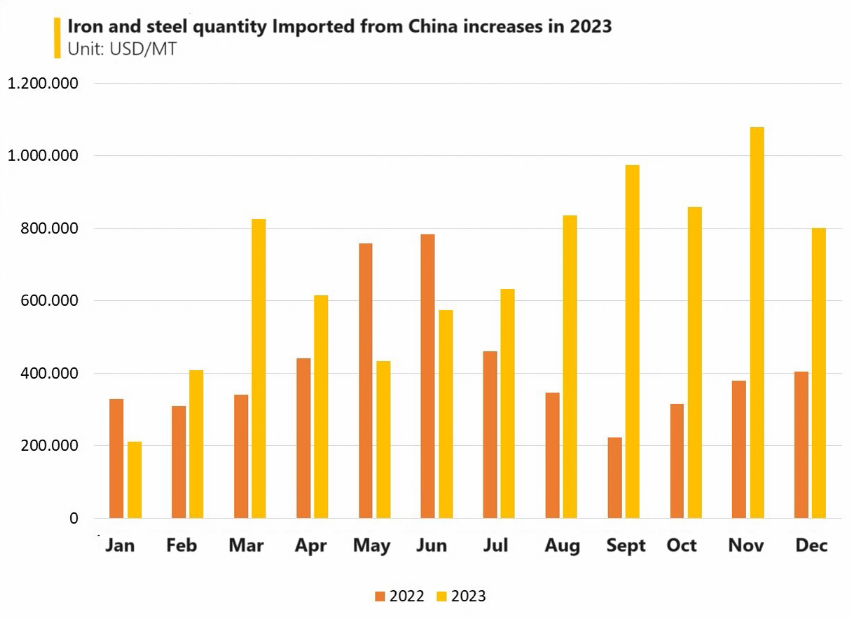

According to preliminary statistics of the General Department of Customs, in 2023, Vietnam imported more than 13.3 million tons of iron and steel, worth over 10.4 billion USD, the average price reached 782.1 USD/ton, an increase of 14%. 1% in volume, but down 12.5% in turnover and 23.3% in price compared to 2022.

In December 2023 alone, our country imported 1.17 million tons of iron and steel, equivalent to nearly 866.7 million USD, average price 740.7 USD/ton, up 22.7% in volume, up 6.7%. in turnover but down 13% in price compared to December 2023.

Previously, in 2022, Vietnam had an iron and steel trade deficit of 3.93 billion USD. Thus, after the first trade surplus in 2021, Vietnam has returned to trade deficit in 2022 and 2023.

In 2023, the most iron and steel imported into Vietnam will originate from China, with 8.2 million tons, equivalent to over 5.65 billion USD, priced at 682 USD/ton, an increase of 62.8% in terms of value. quantity, increasing 13.9% in turnover but decreasing more than 30% in price compared to 2022; accounting for 62.1% of the total volume and 54.2% of the country's total iron and steel import turnover.

In December alone, this country exported more than 800 thousand tons of iron and steel to Vietnam, worth 512.8 million USD, an increase of 98.1% in volume and 59% in value compared to December 2022.

Behind the main market of China is the Japanese market with 1.9 million tons, equivalent to 1.44 billion USD, import price of 753 USD/ton. Next is the Indonesian market with 673,029 tons, worth 1.1 billion USD, priced at 1,658 USD/ton.

The fact that China's iron and steel imports have increased sharply in the current context is because steel products imported into Vietnam have an import tax of 0%.

Furthermore, trade defense measures such as steel billet defense have been removed, other steel products such as galvanized steel sheets, color steel sheets, steel pipes, pre-stressed steel... are not subject to any defense measures. any trade.

Currently, countries around the world are increasingly and thoroughly applying technical barriers and trade defense measures to protect domestic manufacturing industries. Technical barriers are clearly applied in countries such as Thailand, Indonesia, Malaysia, Korea, India, Australia, UK...

According to market research firm Mysteel, China's crude steel output and steel consumption in 2024 are expected to decrease by 0.3% and 0.2% respectively compared to 2023.

On the demand side, China's real estate sector - the country's largest steel consuming market - may have bottomed out, but it is unlikely to recover soon.

Mysteel estimates that in 2024, China's steel exports could decline from 2023 highs under pressure from increased anti-dumping measures from other countries and regions.

At the same time, to reverse the situation of importing high-priced steelmaking raw materials and exporting cheap steel products, China can apply measures to strengthen supervision of steel export procedures, causing export output to decrease. down.

According to China Customs (GACC) data, China's steel exports in 2023 totaled 90.26 million tons, up 36.2% year-on-year, while total export value decreased 8.3% over the same period to 84.6 billion USD. The main reason is due to the imbalance between supply and demand in the domestic steel market, causing Chinese steel enterprises to find ways to handle inventory through steel exports at fiercely competitive prices.

.png)

Write a comment